FOR IMMEDIATE RELEASE | February 7, 2023

Media Contact

Cynthia Martinez

Communications Director

[email protected]

TRAVIS COUNTY PROPERTY OWNERS MAY BE ELIGIBLE FOR TEMPORARY DISASTER-RELATED RELIEF ON THEIR PROPERTY TAXES

AUSTIN, Texas – Travis County property owners may be eligible for a temporary disaster-related exemption to help lower their property taxes if their property was damaged during last week’s ice storm.

According to Travis Central Appraisal District Chief Appraiser Marya Crigler, Property owners who suffered damage to buildings, mobile homes, or business personal property during the recent ice storm may be eligible for a temporary break on their 2023 property taxes.

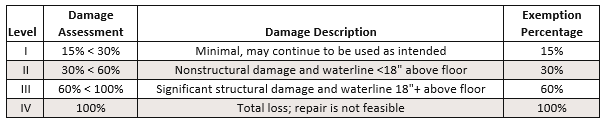

Tax Code Section 11.35 allows for a chief appraiser to determine if a property qualifies for a temporary exemption based on a damage assessment rating of Level I, II, III, or IV. To qualify, a property must have suffered damage that totals a minimum of 15% of the property’s improvement value. The amount of the exemption is determined by multiplying the property’s improvement value, after applying the assessment rating, to a fraction comprised of the days remaining in the tax year after the governor has declared a disaster divided by 365.

Damage to landscaping or trees on a property cannot be included in determining eligibility for the exemption. The temporary exemption lasts until the property is reappraised.

Added Crigler, Travis County property owners will spend the next few months assessing damage and rebuilding their homes and businesses. This temporary exemption can offer some property tax relief during this difficult time.

The deadline to apply for a temporary exemption related to the ice storm is May 22, 2023. Property owners must complete an application and submit it to TCAD by mail, in person (850 East Anderson Lane), or online. More information, including a calculator to help property owners estimate if they qualify for this exemption, can be found on the TCAD website at www.traviscad.org/disasters.

About the Travis Central Appraisal District

The mission of Travis Central Appraisal District, in accordance with the Texas Constitution and the laws of the state, is to provide accurate appraisal of all property in Travis County at one hundred percent market value, equally and uniformly, in a professional, ethical, economical and courteous manner, working to ensure that each taxpayer pays only their fair share of the property tax burden. For more information, please visit www.traviscad.org.

###