TEMPORARY DISASTER-RELATED EXEMPTIONS

Individuals and businesses who suffered property damage as a result of the severe storms and flooding in July 2025, the winter freeze of January 2026, or the increased wildfire risk may be eligible to apply for this exemption.

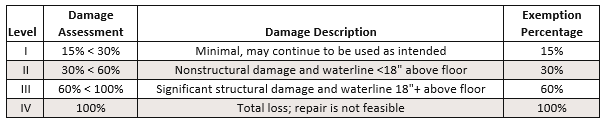

Tax Code Section 11.35 allows a chief appraiser to grant a temporary exemption if a property has been damaged in a state-declared disaster. To be eligible, a property must have suffered damage that totals a minimum of 15% of the property’s improvement value. This includes structures on the property, such as homes or buildings. The exemption benefit is determined by multiplying the property’s improvement value, after applying the assessment rating, by a fraction comprised of the days remaining in the tax year after the governor has declared a disaster, divided by 365.

Damage to landscaping or trees on a property cannot be included in determining eligibility for the exemption. The temporary exemption lasts until the property is reappraised.

Property owners can estimate their potential exemption amount using our Disaster Exemption Estimate Calculator. This calculator does not guarantee any amount will be granted with an application.

To apply for a temporary disaster-related exemption, property owners should complete the application form and return it to the Travis Central Appraisal District. Forms can be returned by mail (P.O. Box 149012, Austin, TX 78714-9012) or dropped off at our office at 850 East Anderson Lane. Applications can also be submitted directly online.

The deadline to apply for a temporary exemption related to the 2025 storms and floods is June 1, 2026.

The deadline to apply for a temporary exemption related to the wildfire risk is May 25, 2026.

The deadline to apply for a temporary exemption related to the 2026 freeze is May 11, 2026.

Prefer to file by mail or office drop box? Click here to download the application form.

FREQUENTLY ASKED QUESTIONS

A homestead exemption lowers your property taxes by removing part of the value of your property from taxation. There are several different types of homestead exemption, including the general residence homestead exemption and exemptions for seniors, people and veterans with disabilities, and some surviving spouses.

You do not have to reapply for a homestead exemption unless the Chief Appraiser requests a new application in writing, you move to a new residence, or your qualifications for an exemption change.

State law requires an appraisal district to audit our exemption records every five years. If the District needs more information to confirm your benefits should continue, you may be asked to reapply.

To qualify for a homestead exemption, you must own and occupy the property on which you are applying. If you recently purchased a home, you may submit the form now and the homestead will be applied to the year in which you qualify.

Yes. Please include a copy of your title to the mobile home or a verified copy of your purchase contract along with your exemption form.

Can’t find the answer you’re looking for?

Check out our Frequently Asked Question library or contact us for more information.