FOR IMMEDIATE RELEASE | April 15, 2021

Media Contact

Cynthia Martinez

Communications Officer

Travis Central Appraisal District

[email protected]

512-834-9317 ext. 226

2021 APPRAISAL NOTICES ON THEIR WAY TO TRAVIS COUNTY PROPERTY OWNERS

Deadline to file protests is May 17

AUSTIN, Texas – Travis County property owners can expect to receive their 2021 appraisal notices from the Travis Central Appraisal District (TCAD) in the coming weeks.

Notices of Appraised Value are being mailed out to 389,530 Travis County property owners this week. The notices include the market value assigned to a property as of Jan. 1 and the taxable value of that property based on its exemptions.

According to Chief Appraiser Marya Crigler, “Travis County property owners can expect important information from the appraisal district to arrive in their mailbox as early as this week. In addition to information on their market values, property owners will receive important information on exemptions and the protest process.”

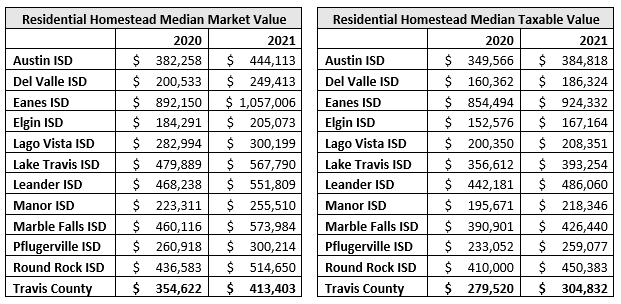

Overall, the Travis County appraisal roll increased 12% to $322.9 billion, led by more than $3.9 billion in value increases for residential properties. According to this year’s values, the 2021 median market value for a residential property in Travis County is $413,403 and the median taxable value of a residential property is $304,832.

“Some residential property owners may see significant increases in their market value due to a lack of supply and high demand in the local housing market,” added Crigler. “However, property owners with a homestead exemption will still benefit from a 10% cap on the increase of their taxable value.”

Property owners who believe their property’s market value is incorrect have the right to file a protest with the appraisal district. The deadline to file a protest is May 17. Travis County property owners are strongly encouraged to file their protests online through the TCAD online portal. Property owners who file via the portal can upload their evidence, review the appraisal district’s evidence, and review a settlement offer through their online account. Protests and evidence will also by accepted by mail and through the drop box located outside the TCAD office (850 East Anderson Lane).

The informal process, which allows property owners to receive a settlement offer from the appraisal district, will begin April 19 and end June 18. During that time, property owners will have the opportunity to discuss their property with a TCAD appraiser. Informal meetings will take place by phone and on a first come, first served basis. Property owners should ensure that their protest has been filed and evidence processed before getting in line for an informal meeting.

Property owners who do not accept a settlement offer during the informal process will have the opportunity to present their case to the Travis Appraisal Review Board (ARB), an independent group of citizens authorized to resolve disputes between taxpayers and the appraisal district. ARB hearings are expected to begin in June 2021.

Added Crigler, “Demand for informal meetings will be very high this year. Travis County property owners who want the opportunity to meet with a TCAD appraiser should file their protest and get in line online as soon as possible.”

TCAD will be hosting a webinar to help property owners understand their Notices of Appraised Value Wednesday, April 21 at 1:30 p.m. A webinar on the 2021 protest process will be held Wednesday, May 5 at 11:30 a.m. Registration for both events is available at www.traviscad.org/webinars.

Property owners can find more information on market values and the protest process on TCAD’s website at www.traviscad.org.

About the Travis Central Appraisal District

The mission of Travis Central Appraisal District, in accordance with the Texas Constitution and the laws of the state, is to provide accurate appraisal of all property in Travis County at one hundred percent market value, equally and uniformly, in a professional, ethical, economical and courteous manner, working to ensure that each taxpayer pays only their fair share of the property tax burden. For more information, please visit www.traviscad.org.

###